***Cheapest Health Insurance Plans*** The cheapest health insurance plans often include high-deductible health plans (HDHPs) and catastrophic health insurance. These options provide basic coverage at lower premiums.

Finding affordable health insurance is crucial for many people. High-deductible health plans (HDHPs) typically have lower monthly premiums, making them a popular choice. These plans cover essential health benefits after you meet the deductible. Catastrophic health insurance is another budget-friendly option.

It offers protection against worst-case scenarios like major accidents or severe illnesses. While these plans have high deductibles, they provide a safety net for significant medical expenses. Comparing different plans, understanding your health needs, and considering potential out-of-pocket costs can help you choose the best and most affordable health insurance. Always review the details to ensure the plan meets your requirements.

Are you tired of overspending on your favorite items? Discover effective saving strategies with Mypricezone that can help keep your wallet happy without compromising on the things you love. From coupon codes to cashback offers, these tips can make a real difference in your shopping experience.

Introduction To Affordable Health Insurance

Health insurance is very important. It helps cover medical costs. Medical bills can be very expensive. Without insurance, paying these bills can be hard. Health insurance protects you from high costs. It provides peace of mind. You know you are covered if you get sick or injured.

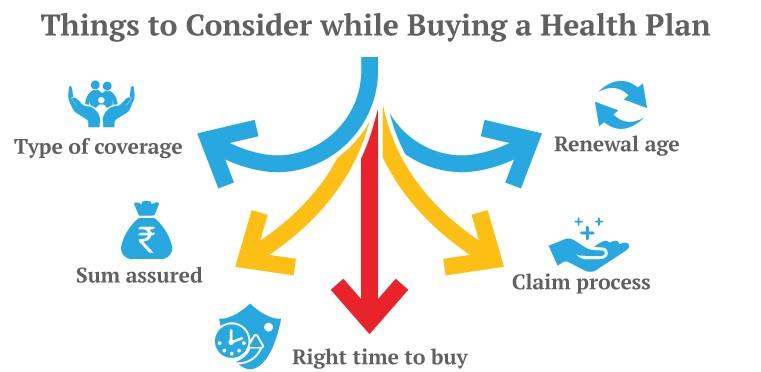

Finding a good health insurance plan is key. Cheap plans may not cover everything. Expensive plans may have too many extras. Balance cost and coverage to find a good fit. Look for plans that cover your needs. Check what doctors and hospitals are included. Make sure the plan fits your budget.

Types Of Health Insurance Plans

Health Maintenance Organizations (HMOs) offer low-cost premiums. You must choose a primary care physician (PCP). Referrals are required to see a specialist. HMOs are good for basic healthcare needs.

Preferred Provider Organizations (PPOs) allow more flexibility. You can see any doctor, but in-network doctors cost less. No referrals are needed for specialists. PPOs might have higher premiums and deductibles.

Exclusive Provider Organizations (EPOs) combine features of HMOs and PPOs. Lower premiums but no out-of-network coverage. No need for referrals. EPOs are suitable for predictable healthcare needs.

Point of Service (POS) plans need a primary care physician. Referrals are needed for specialists. POS plans offer out-of-network coverage, but at a higher cost. These plans offer balance between cost and flexibility.

Factors Affecting Insurance Premiums

Various factors influence the cost of health insurance premiums. Age, lifestyle choices, and existing medical conditions play significant roles. Finding the cheapest health insurance plans requires comparing options based on these critical factors.

Age And Health Status

Older people usually pay higher premiums. Young people often get cheaper rates. Healthier individuals also get lower premiums. Chronic illnesses can increase the cost. Good health habits may reduce your premium.

Geographic Location

Where you live affects the cost of insurance. Cities with high living costs have higher premiums. Rural areas might offer cheaper plans. State regulations can also impact prices. Local healthcare costs play a big role.

Coverage Level

Basic plans cost less than comprehensive ones. More coverage means higher premiums. High deductibles can lower your monthly cost. Low deductibles usually mean higher premiums. Choose a plan that fits your needs and budget.

Finding The Right Plan

Start by knowing your needs. Do you visit the doctor often? Think about your health and past medical history. Make a list of your essential needs. This will help you find the best plan. Check if you need special treatments or medicines. Knowing these details will save you money.

Compare the monthly premiums of each plan. Look at the deductibles and co-pays. Some plans have lower premiums but higher deductibles. Choose a plan that fits your budget. Make sure your preferred doctors are in the network. Check the benefits offered by each plan. This can include dental and vision coverage.

Government And State Programs

Medicaid helps low-income families get health care. It is free or very cheap. Many people can use Medicaid. Each state has its own rules. You must meet income limits to qualify. Medicaid covers doctor visits, hospital stays, and more.

CHIP stands for Children’s Health Insurance Program. It helps kids get health care if their families make too much for Medicaid. CHIP is cheaper than other plans. It covers doctor visits, shots, and medicines. Kids stay healthy with CHIP.

Marketplace subsidies help people pay for health insurance. They lower monthly costs. You can get subsidies if your income is low. Subsidies make health plans more affordable. Many families use these subsidies.

Tips For Reducing Premiums

Eating healthy foods can lower insurance costs. Regular exercise keeps you fit and saves money. Avoiding smoking reduces health risks and premiums. Staying active helps you stay healthy. Maintaining a healthy weight is important.

Choosing high-deductible plans can save money. These plans have lower monthly premiums. Be prepared to pay more out-of-pocket. They work well for healthy people. Check if your provider offers this option.

Preventive care helps catch problems early. Insurance often covers these services for free. Regular check-ups can prevent serious issues. Vaccinations keep you healthy and reduce costs. Screenings can find diseases early.

Read More

How to Make the Best Restore Health Potion Skyrim?

Common Mistakes To Avoid

Many people overlook the fine print in health insurance plans. This can lead to unexpected costs. It’s important to read all the terms and conditions. You should understand what is covered and what is not. Don’t ignore the deductibles and copayments.

These can add up quickly. Always check if the plan includes preventive care. This can save you money in the long run. Read the exclusions section carefully. Some plans do not cover certain treatments.

Network restrictions can limit your choice of doctors. Always check if your preferred doctors are in the network. Out-of-network visits can be very expensive. Look for plans with a large network of healthcare providers.

This gives you more options. You should also check the hospital network. Make sure the plan covers nearby hospitals. Some plans only cover specific hospitals. This can be a problem in an emergency.

Final Thoughts On Affordable Coverage

Choosing the right health insurance plan can lead to significant long-term savings. Affordable coverage doesn’t mean compromising on quality. Many plans offer preventive care services at no extra cost.

This helps in catching health issues early and avoiding expensive treatments later. It’s essential to compare different plans and consider your medical needs. Monthly premiums might be low, but always check for hidden costs. Investing in a plan with a slightly higher premium but better coverage can save money in the long run.

Comprehensive health insurance provides a wide range of medical services. These services include doctor visits, hospital stays, and prescription drugs. Make sure your plan covers specialist visits and emergency care.

Some plans might exclude certain treatments or have waiting periods. Always read the policy details carefully. A good plan should protect you from unexpected medical expenses. Having comprehensive coverage gives peace of mind and ensures you get the best care when needed.

Conclusion

Finding the cheapest health insurance plans can save you money without compromising on coverage. Compare options carefully and consider your needs. Affordable health insurance is essential for financial security and peace of mind. Make an informed choice to protect your health and wallet.

Start exploring your options today for the best deals.